Are you ready for the 2024/25 Tax Year? With the new tax year fast approaching we highlight the HMRC changes that employers need on their radar.

It doesn’t seem long ago that we were ringing in the New Year and now we are fast heading towards a new tax year, which brings with it new statutory rates, submission deadlines and year end tasks that need to be completed.

Now is a good time to get prepared and with this in mind we have put together a handy update of what’s to come:

Year Ending 2023/24

Do you understand your responsibilities for year end?

- Send your final Full Payment Submission, this must be submitted on or before your employees’ last payday of the tax year which is 5 April.

- All employees on the payroll will need to have a P60 produced and given to them either on paper or electronically by 31 May 2024.

Special mention in relation to Directors and treatment of their NI

Directors on the payroll that have their NI taken on the alternative basis will need the payroll set to the Standard earnings method in Month 12 to ensure that the directors have paid over the correct amount of National Insurance for the year and will pay any additional NI due over in month 12.

For 2023/24 the Directors NI main primary percentage that will be used in the month 12 calculation is a blended rate of 11.5%. This is to account for the old Primary percentage of 12% percentage from 6 April 2023 to 5 Jan 2024and the new primary percentage of 10% from 6 January 2024 to 5 April 2024.

Where a director is paid using the alternative arrangements, then their class 1 NICs are calculated as if they were an employee, but the blended rates apply to the end-of-year reconciliation. Where the standard method is used, then the blended rates apply for the whole of the tax year.

Onto a New Year 2024/25

What needs doing?

- For each employee make sure there is a payroll record showing the correct tax code to be used effective 6 April 2024.

- Ensure the payroll software is up to date with the latest rates and thresholds for tax, National Insurance and student loan repayments.

Payrolling Benefits 2024/25

Do you intend to start payrolling benefits in the 2024/25 tax year? If so, you will need to make sure you have registered with HMRC to payroll benefits by the start of the new Tax year (6th April 2024). You can payroll all benefits except employer provided living accommodation and beneficial loans so be aware you will still need to submit P11D’s if any of these apply.

Expenses and benefits have to be reported by 6 July to HMRC and payment of associated Class 1A National Insurance received by 22 July.

Changes to Statutory Pay in 2024/25

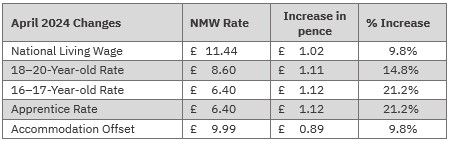

National minimum and living wages are increasing in April 2024 the new rates are as follows:

The rate for Statutory Maternity, Paternity, Adoption, Parental Bereavement and Shared Parental Pay is increasing to £184.03 per week. The new rate for Statutory Sick Pay is £116.75 per week. All Existing Qualifying rules on the Statutory Pay remain unchanged

The Tax-free earnings threshold continues to be £12,570 and the standard tax code will remain unchanged at 1257L

Finally, is 2024/25 the year you may be looking to outsource your payroll? Why not give us a call and have a chat with one of the team to discover what makes advo different.