Boris Johnson pledged to implement the biggest increase to National Minimum Wage (NMW) in more than 20 years. There is both the NMW for those of school leaving age and the National Living Wage (NLW) for those aged 25 and over.

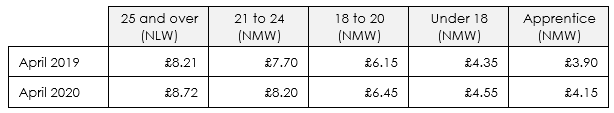

Below shows a table of the increases for April 2020:

Employers need to ensure that all workers are paid in line with the new rate when this takes effect on 1st April 2020. HMRC can conduct spot checks to ensure workers are being paid at the correct rate, highlighting the requirement to comply. It is the employer’s responsibility to keep records proving that they are paying the minimum wage, with most employers using payroll records evidence of compliance. All records have to be kept for three years.

Some common errors where pay levels are incorrect include: not amending pay rates when employees move up a band due to a birthday and making deductions from wages which then reduce the employee’s pay to below their NMW or NLW rate.

It is a criminal offence to not pay the appropriate rate of pay in line with the above rates as a minimum. Employers can choose to pay above this. If an employer has not been paying the employee at the correct rate, they need to arrange payment to reimburse them for the missed payments. An employer could be issued a fine of up to £20,000 per worker if employers are in breach of the minimum wage legislation or could be taken to court by HMRC on behalf of the worker if the employer refused to pay the arrears.

What is our take-home message? Ensure that you are currently paying all workers at the correct rate if you pay in line with NMW and NLW. As of 1st April 2020, ensure that any workers that are paid at NMW and NLW receive the correct increase. If it transpires that the incorrect rate of pay has been paid, then pay any arrears as soon as possible, explaining to the employee what has happened and how it is being rectified.

Do you need payroll support? advo offers fully HMRC compliant payroll processing at discounted rates for existing advo HR clients. To find out more email advo Payroll on info@advogroup.co.uk