In a wide ranging interview advo’s Colin Boxall discusses Vitality’s approach, capabilities and future plans with Athos Rushovich.

In 2015 Athos was appointed to lead both Vitality’s Specialist Health Distribution, and Vitality Adviser businesses. He has since been instrumental in guiding Vitality to greater success within with the intermediary advisory community. advo took the opportunity to catch up with Athos to find out more about his views on Vitality and how they work with UK businesses.

Colin [advo]: Many people are now aware of Vitality through sports sponsorship, sports personalities and of course Stanley the dog, but do you think the general public understands what Vitality is all about?

Athos [Vitality]: As the brand becomes more ubiquitous, both here and internationally, more people associate Vitality with Health and Wellbeing. While we are pleased with the progress, we also know that we have a long way to go before we have an absolute association between the brand and why we exist.

Colin: I have heard it said that the Vitality proposition is confusing to employers – Is this a medical insurance policy or a wellness programme?

Athos: In order to provide real healthcare, we believe that a balance between Health and Care is imperative, and the integrated solution that Vitality offers, provides not one or the other, but absolutely both in balance.

Colin: Vitality and wellness programmes generally only work with top-down support within an organisation. How do you enthuse board members to embrace the Vitality approach?

Athos: We can easily illustrate the causal connection between wellbeing, and productivity, making a commercial case for investing in a holistic wellness proposition which is easily understood by board members.

Colin: What do you see as the main barriers and steps to be taken for an employer who wishes to improve overall health of their workforce?

Athos: : We know that smaller companies face the same risks as large corporates, but they do not have access to the same resources to build programs that can deliver results. Vitality at Work enables this.

Colin: Using Vitality, how can an organisation appeal to a diverse workforce with different ages, likes and life goals?

Athos: The science of Vitality is age agnostic, empowering members to engage with their own health and wellbeing through powerful incentives. This impacts the entire workforce in a profound way. We have millions of data points from Britain’s Healthiest Workplace to validate this position.

Colin The recent launch of improved policy benefits including more supportive mental health cover and new ‘Vitality partners’ including Amazon Prime received positive reviews but with all the additional benefits how can Vitality have similar pricing to other UK health insurers?

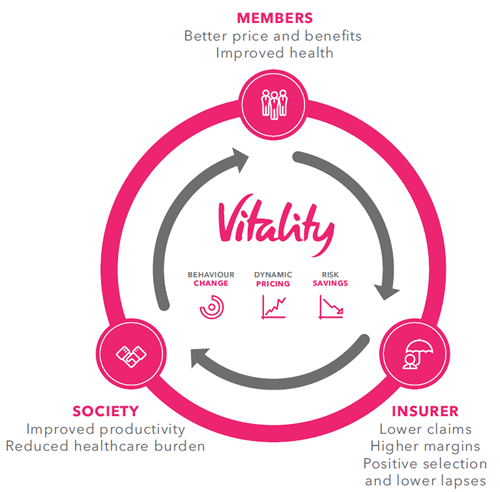

Athos: :The essence of Vitality is to improve the way that our members engage with their health. This in turn improves the Vitality risk experience through reduced claims spend. Which delivers an actuarial surplus that we apply to rewards for our members, creating a virtuous cycle.

Colin: The new Vitality Essentials policy allows a wider workforce to engage in Vitality programmes and not just those covered by private medical insurance. In many instances this is available without any additional charge. Is this a short-term offer or a long-term sustainable proposition?

Athos: This is a permanent feature of our product range, at no additional cost, but it does carry some eligibility criteria. It is an extension of improved risk experience and broader engagement in an employer population further improves the efficacy of Vitality.

Colin: Does the Vitality approach fit with all employers?

Athos: Absolutely, even if one opts to ignore the wellness element, our PMI benefits, we believe are market leading and offer unparalleled cover, and the proposition includes the Vitality wellness program.

Colin: The administration hub saves time for brokers that manage client policies and was well received; are their plans to invest further so that broader administration of policies is possible?

Athos: We are investing widely in technology, and this is bedded into our long term strategy, we will be enhancing the scope of self serve administration on a continual basis.

Colin: Many brokers compare just medical insurance coverage, excluding any wider policy benefits when sourcing the right health insurance policy for clients. Is this the right approach? If not what additional cost value should be considered?

Athos: Vitality’s solid benefits, combined with improved wellness (and productivity) , are further enhanced by the very real benefits of Full Cover, Vitality GP, Employer Cash Back and Employee rewards. These considerations must be factored into the overall value and cash flow decision.

Colin: Vitality may be a global brand but unlike the other large UK insurers has no international medical insurance option. Is this likely to change?

Athos: Presently, we are focussed on continually improving our on-shore proposition, and it is unlikely that we will venture into this market in the near future.

Colin: The online GP service that Vitality pioneered on a medical policy is now established as a reliable alternative to face-to-face. Do you think this would be carried forward to include specialist consultations?

Athos: This is an interesting question, we are constantly evaluating many technological advances, and, I feel sure that tech-medicine will evolve at a rapid pace. Where ever this path leads, it is our intention to pioneer solutions for our members.

Colin: What is the overall aim of the Vitality organisation? Where next for Vitality UK?

Athos: Our core purpose is ‘To make people healthier, and enhance and protect their lives’

If you break this down into it’s component parts, Making people healthier is achieved through the Vitality program, Enhancing their lives happens by way of both improved heath and also rewards, and Protecting their lives, is a function of excellent Health and Life cover.

This is the fundamental reason for being of our business.

It is interesting to note that our 5 year goal is to add 1 million years of life to our members, this sounds lofty, and perhaps even crazy, but, by engaging our 1 million members in the Vitality program, we can quite conceivably improve each members life expectancy by 1 year, through improved health and wellbeing, and thereby add 1 million life years to our members.

advo works closely with Vitality managing the healthcare needs of many mutual clients and is a supporter of their ethos and approach to health and wellbeing.

Who is Athos?

Athos has 25 years experience in the financial services industry, spanning the Health, Life and Investment segments, and he has worked in both the intermediated and dedicated distribution arenas.

He joined the Discover Group in 2001, has held various positions within the group, working both in South Africa, and in the UK, where he established the Franchise Distribution model in 2008. He returned to the UK in 2015 to take up his current position, leading both the Specialist Health Distribution, and Vitality Adviser businesses.

Athos has served on, and chaired industry bodies.

He is married to Sam, and they have two children.

You can find out more about Vitality here.