Giving up part of your pay every month might sound like a strange idea, but in many instances, it can make financial sense to both employers and their employees.

These salary sacrifice options allow an employee to exchange part of their salary for a non-cash benefit from their employer, such as increased pension contributions, but there are rules around how this can be implemented.

What is a salary sacrifice?

A salary sacrifice arrangement is an agreement to reduce an employee’s salary/earnings, in return for non-cash benefit. Some employers have salary sacrifice schemes available to their employees in the form of Childcare Vouchers (closed to new entrants October 2018), Cycle to Work (C2W) scheme or salary sacrifice pension schemes.

Salary sacrifice schemes have proven to be hugely popular with staff with both employer and employee benefiting.

Who benefits?

The main advantage to implementing a salary sacrifice scheme are the savings in National Insurance Contributions. The employer and employee will benefit from these savings.

Do I have to report a Salary Sacrifice scheme on a P11D?

The only benefits that are not required to be reported to the HMRC in relation to salary sacrifice are:

- Pension scheme payments

- Employer provided Pension scheme advice

- Workplace nursery

- Childcare vouchers

- Bicycles and cycling safety equipment (C2W)

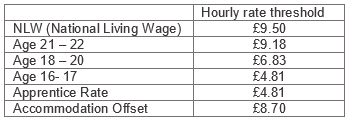

Employers please remember – It is unlawful to reduce a worker’s rate of pay below the National Minimum Wage (NMW) or National Living Wage (NLW). If joining a salary sacrifice arrangement would cause this to happen, the employer is obliged to exclude workers from the arrangement.

Why?

The Government invited the Low Pay Commission (LPC) to consider whether the salary sacrifice schemes involving childcare should count towards NMW and NLW.

The LPC recommended that the salary sacrifice schemes should NOT count towards the NMW or NLW: “with the exception of accommodation, it should not be possible to substitute benefits-in-kind for cash pay to make up the NMW.”