Almost a third of UK adults aged between 45-54 are concerned that the financial strain caused by the coronavirus pandemic is negatively impacting their mental health, according to latest research.

The research by Aviva1, into how personal finance issues have been exacerbated during lockdown, reveals that the ‘sandwich generation’ (45-54 age group) are shouldering the heaviest financial burden as a result of the pandemic. More than half of this age group (55%) are more worried about their financial situation now than before lockdown, and 1 in 6 (16%) say that their adult children have become more financially dependent on them as a result of the Covid-19 – the highest of any age group.

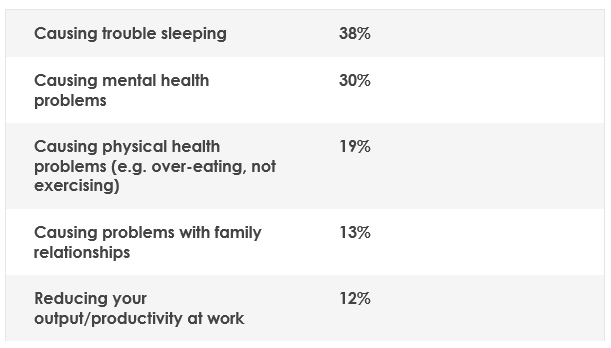

The high levels of concern among this age group are negatively impacting many. Along with mental health problems, almost 2 in 5 (38%) are having trouble sleeping, 19% are experiencing physical health problems, and 13% say that it is causing problems with their family relationships – highlighting the importance of supporting people to take proactive steps to improve their financial position.

Table 1: What negative impacts, if any, are you worried about your financial situation having on you?

Alistair McQueen, Head of Savings and Retirement at Aviva, comments: “The economic impact of Coronavirus has been laid bare and our research has revealed the significant mental health impact that the financial concerns have caused. While no one is immune to the knock-on effects that the economic downturn will have – the impact on the mental health on the squeezed middle is far-reaching. Too often this generation finds themselves shouldering their own financial burden, and at least part of their children’s, and it’s vital that more support is offered to them.

“This means millions are acting alone, hoping for the best. We believe that part of being a responsible employer is about looking after the wellbeing of your employees, which is why Aviva has introduced a national Mid-Life MOT programme which helps people to embrace opportunities by encouraging them to consider their wealth, work and wellbeing needs from the age of 45 and plan for their futures.”

Aviva’s research also revealed that the majority (60%) of mid-life adults who discussed their finances with a family member or close friend feel better for having discussed it – highlighting how important it is to encourage people to be more open with their loved ones about their finances.

Over half (53%) agreed that they feel closer to their family and friends as a result of opening up, 49% now feel less embarrassed or inhibited when talking about money, and 48% have learnt about new options for their finances having had a conversation.

Alistair McQueen, continues: “Having open and frank conversations with family and friends is the first step to improving your financial situation, however too often these conversations are avoided or put off all together. Speaking about your financial concerns can lighten your load, reduce the stigma, and encourage the sharing of advice and guidance.

Aviva’s top-tips for improving mental health caused by financial concerns

- Take time out: Striking the balance between responsibility to others and responsibility to yourself can reduce stress levels, so tell yourself it’s okay to take some time to prioritise your self-care.

- Share your worries: Suffering alone adds to the pressure. Share the situation with friends or family if you can. Even if they can’t help, just talking to someone could help you see the problem with a clearer focus. The Money Advice Service offers a helpful guide on how best to open up and talk about money.

- Take control on your own or with the help of a financial adviser: If you are able to, accessing regulated financial advice will give you more confidence to plan your financial future.

- Be mindful: Mindfulness is a mind-body approach to life that helps us to relate differently to experiences. It involves paying attention to our thoughts and feelings in a way that increases our ability to manage difficult situations and make wise choices.

- Understand your current savings and projected retirement fund: Identifying how much your exact level of current savings and monthly saving contributions will leave you with in retirement can help you adapt your long-term financial goals.

- Don’t be too hard on yourself: Remember, there is no right way to do anything, and it’s unhelpful to compare yourself to others. Try to keep things in perspective and take a few minutes each day to appreciate yourself.

Notes:

1Aviva research of 2,000 UK consumers conducted on behalf of Aviva by Censuswide, August 2020. Of which there are 301 respondents aged 45-54. All statistics in this release relate to this research focused on 45-54 year olds. Statements where respondents agree, based on those who strongly agree and somewhat agree with the statement.

You can read the Aviva npress release in full here.