Staff benefit communication could be much improved according to a new survey. Employees wish their employer would communicate more about the workplace benefits available to them with one in ten not knowing what benefits they have.

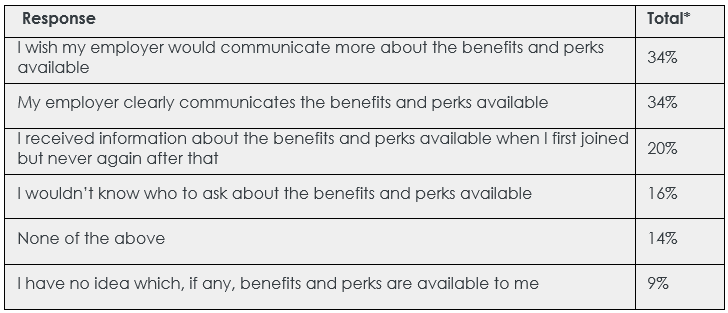

Employers are not doing enough to communicate workplace benefits to staff, according to new research from Canada Life. A third (34%) of employees – equivalent to 11.2 million people – wish their employer would communicate more about the workplace benefits available to them.

One in five (20%) received information about the benefits available to them when they first joined but never again, while one in ten (9%) have no idea which benefits, if any, are available to them.

The lack of communication represents a real problem for employers because when implemented properly, workplace benefits improve employee wellbeing and create a happier, healthier workplace environment.

Table 1: Lack of communication of workplace benefits to employees

*Responses do not add up to 100% as respondents could select more than one answer

Employers can improve their standing with employees by offering benefits

Despite the distinct absence of clear communication, most employees believe that their employer adopts a positive approach towards their wellbeing. Three quarters (75%) of employees think that their wellbeing is important to their employer, rising to 83% for employees aged 18-34.

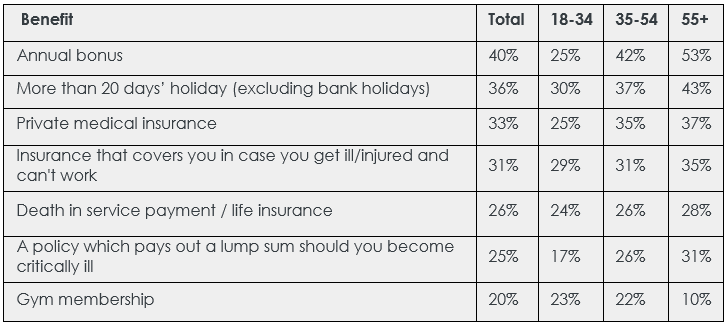

However, employers can do more to improve the perception that they take employee wellbeing seriously. Two fifths (40%) of employees feel more positive about their employer if they offer an annual bonus, or would if they don’t already offer one, and a third (33%) said the same for private medical insurance.

In terms of protection products, across all age groups employees would feel more positive about their employer if they offered them income protection (31%), life insurance (26%) or critical illness cover (25%) over a gym membership (20%). Only 18-34-year-olds would feel more positive about their employer if they were offered a gym membership over critical illness cover (23% vs.17%) and would still prefer to be offered life insurance (24%) or income protection (29%).

Overall, the proportion of employees who would feel more positive about their employer if they were offered protection products increases with age.

Commenting on the research, Paul Avis, Marketing Director at Canada Life said: “Workplace benefits should be a top priority for employers. Not only do they improve employee wellbeing, they are useful tools to attract and retain top talent which will become increasingly important as the war for talent intensifies. Worryingly, many employers who have made the positive step of putting an effective benefits package in place are not reaping the rewards because they are failing to communicate their availability properly. Although this is a significant problem, there is a simple solution.

Table 2: Workplace benefits that would make employees feel more positive about their employer

In an effort to communicate workplace benefits clearly to employees, or advertise perks already in place, employers should regularly re-evaluate their communication channels.

Over half (56%) of employees would prefer to receive information on workplace benefits via email, followed by face-to-face interactions (29%) and an intranet hub (26%).

Paul Avis added to his comments by stating that “Employers should re-evaluate their communication methods and learn what works for their employees. Our research suggests a renewed focus on email updates, face-to-face communication or an internal intranet system is a good place to start to fully articulate the availability of workplace benefits and give regular updates. This will ensure that all staff members understand which perks are available to them and will ultimately improve their perception of their employer.

“Advisers also have a role to play in arming employers with the information and tools necessary to effectively promote benefits within the workplace, ideally working in close partnership with the insurance provider.”

You can view the original Canada Life news story here.